No One’s Helping Us Buy Less Stuff

Shopping online is easy, and companies want your business. While these might strike you as obvious statements, the ease of one-click buying and its counterparts doesn’t always make for responsible credit. In-store shopping isn’t much better with the endless zero percent financing offers and pressure by salespeople.

The job of any business is to get you to buy more stuff, not less. Petal is here to change all that. With no fees, cashback, and the ability to set a budget the card won’t allow you to bypass, Petal could very well be the best starter credit card on the market. Even Credit Karma thinks so. They said as much in their recent review of the Petal Visa Credit Card.

Priced Just Right

When you’re trying to build responsible credit, the last thing you need is a bunch of unnecessary fees to drag you down. A fee just for the privilege of receiving a credit card? We’re assuming you would say a hearty no thanks to that offer.

Petal offers a variable interest rate on its Visa product of 15.24 to 26.24 percent depending on your credit history and other unique factors. Even if you have little credit, you could qualify for the lowest rate if you have managed it well. This is highly competitive with other Visa credit cards, even those not specifically marketed to people looking for the best starter credit card. As part of your responsible use of credit, it’s a good idea to avoid high balances when your interest rate falls at the higher end of the scale. If you don’t, you could end up paying more for interest charges than you did for the original purchase.

Petal understands that not all consumers have the same needs when it comes to accessing available credit. If this is your first credit card, you will start out with a credit limit of at least $500. If you have managed other credit cards well over the past several years, you could find yourself with a credit limit as high as $10,000. When the company says it’s priced just right, that’s exactly what it means. You will receive a credit limit that fits your circumstances perfectly.

App Built by a Tech Company, Not a Bank

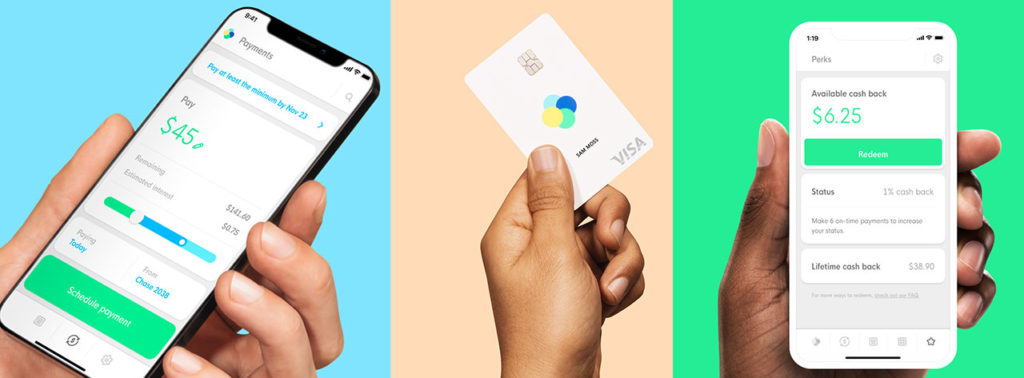

When you take the time to download an app, it’s helpful if the people who developed it work in technology and not banking. This is the best way to make sure the app will do what you need it to do without frequent crashing or providing you with irrelevant information. Petal, which is available on Apple and Android, comes with several financial tools you won’t find with just any credit card. The company understands that many of its customers are first-time credit users and wants to help them establish responsible credit. Here are just some of the tools you can use to do that:

- Interest calculated per payment: When you enter a payment amount, the Petal mobile application automatically displays how much of it will go towards interest. This can help motivate you to pay off your balance faster to help save on interest charges.

- Create a budget: Just because you receive a certain credit line doesn’t mean you need to spend up to that amount. You know your finances and how much you can afford to charge and repay each month. With the Petal Visa, you have the option to set a budget for the maximum amount you can put on your card. The app shows you how much you charged during the month, your statement balance, and how much credit you have available to stay within your budget.

- Credit score tracking: Your credit score can range anywhere from the low 300s to approximately 850. This number is critical since it’s what lenders use to determine whether to extend you credit or not. You can easily monitor your credit score in the Petal app and create a plan to improve it if necessary.

- Cashback status: The app displays how close you are to reaching the 1.25 percent and 1.50 percent thresholds to receive cashback for making your payments on time.

- Balance check: With your authorization, Petal can check the balance of the account you pay with to ensure you will have enough to pay at the least the minimum amount due.

- Schedule automatic payments: With just a few taps on your smartphone, you can set up automated payments from your bank account to Petal.

- Card freeze: If you have misplaced your card, think someone might have stolen it, or just don’t want to use it right now, Petal enables you to turn off the ability to charge.

- High security: The biometric identification feature of Petal integrates with the security on your smartphone to ensure your sensitive account data remains secure.

Rewards That Grow with You

With so much competition among financial institutions to offer the best starter credit card, companies should be paying you for using their brand and not the other way around. That is exactly what Petal does. You receive one percent cash back on purchases right away,1.25 percent back after paying on time for six straight months, and 1.5 percent cash back once you have paid your credit card bill on time for 12 consecutive months. How’s that for reward and motivation?

What Do You Mean No Fees?

It might seem hard to believe, but you can trust us when we say that the Petal Visa credit card has no fees whatsoever. You can even look at the fine print and you still won’t find any. We already touched on the fact that there’s no fee to receive the account nor is there an annual fee to maintain it. Some of the other fees you will neither see nor pay include late fees and international use fees. The only amount you will pay above what you owe on the account is interest charges.

No Credit Score, No Problem

Everyone has to start somewhere when it comes to establishing responsible credit. If you’re one of the millions of Americans with no credit history due to age, recent immigration to the United States, or are just someone who normally pays cash for what you need, you will love the Petal credit card. The company is more interested in your spending, payment, and savings habit than it is in a three-digit number you may have had no opportunity to develop just yet. It uses the built-in cash flow technology to determine your risk factor even with little to no credit.

The best part? Petal reports to Equifax, Transunion, and Experian, the three major credit reporting agencies. As you make your payment on time each month, you develop a positive payment history and increase your credit score. Having a high credit score is one of the best things you can do for your financial situation. You will need it in the future when you apply for larger loans such as a mortgage or a new car.

Petal’s willingness to work with people new to credit or who have only fair credit as opposed to good or excellent is just one of the factors that make it the best starter credit card in the financial services industry. You can go ahead and compare features between Petal and other starter credit cards on websites like Credit Karma or Credit.com. However, you won’t find a similar type of account with as many benefits as Petal.

See if You’re Approved for Petal with No Credit Score Impact

Did you know that every time a business requests your credit report it can cause your credit score to drop a few points? Petal understands that is not something people with little to no credit in the first place can afford to have happened to them. For this reason, you can apply for the company’s Visa credit card without it having any impact on your credit score. The inquiry will show on your credit report along with those from other companies that offer the same benefit to their customers. Your credit report also has a section for inquiries that do count towards your credit score.

The Petal Credit Card is Big News

Petal formed as a start-up company back in 2015, attracting the attention of several big names in the process. The business website Inc., the New York Times, Forbes, Bloomberg, and Tech Crunch, are just some of the well-respected names in publishing and finance that understand something special when they see it. The card is so successful that more than 100,000 people signed up as to participate in its private beta phase. Once it became available to the public, thousands more flocked to apply for the card that offers no fees, cashback, a user-friendly smartphone application, and other unique benefits.

Whether you’re applying for your first credit card or you have operated on a cash and carry policy until now, you can apply for a Petal Visa card and receive a response within seconds. Once approved, you can begin enjoying the rich benefits right away as you work to secure your financial future.

Lisa Kroulik is a freelance content marketing writer with eight years of experience. She has a special interest in helping readers make sound financial decisions and financial recovery topics. After having filed bankruptcy in 2008, Lisa took the opportunity to make a fresh start and learn from her mistakes. Today she has a credit score of 830 and no debt other than a mortgage.